Magento Payment Gateways: Online Shopping Made Easy

You might have the most amazing Magento store out there, but it doesn’t matter if customers can’t pay for your products without getting frustrated.

That’s why you need to choose a reliable payment provider.

Such integrations are designed to provide a variety of payment options, from credit and debit cards to digital wallets and even alternative methods, such as Buy Now Pay Later (BNPL). They are also secure, employing numerous approaches to protect your customers’ data.

So, how are you supposed to choose the best provider? What do you need to look for? How to add the extension?

That’s what we’re here for. Our guide will explain everything you need to know to select a suitable payment gateway for your Magento store and integrate it on your own.

Here’s the deal:

Choosing a Payment Gateway

Choosing a suitable payment method for your Magento store might seem intimidating. After all, there are a lot of options on the market.

In reality, it’s not that hard.

Start by outlining your specific business requirements and suitable budget. Consider things like volume and value and your customer base’s geographical distribution. This will help you narrow down solutions with appropriate features. For example, multi-currency support is essential to cater to a global audience. Mobile payments are also crucial, which is why most vendors offer those as in-built features.

Choose a solution that can grow with your business. You’ll need something that can handle both bigger and smaller transaction volumes with enough reliability. Reminder – check the transaction fees. Read the terms and conditions thoroughly to avoid any hidden costs. It’s important to choose a payment gateway that fits your budget.

Of course, security is a top priority. To protect customer data, see if the tools are PCI-DSS compliant. It’s also important to check for advanced fraud detection tools and robust data encryption.

Last but not least, evaluate the customer support. The team needs to be available through multiple channels such as email, phone, and live chat. Always check reviews and feedback from other users to see if the tool and the support are reliable enough.

IMPORTANT: Always check if the Magento extensions you’ve chosen are compatible with your current application version.

Payment Gateway Integration and Configuration

Once you’ve selected your payment method, you have to create an account. Add all the necessary info, such as email and password, and whatever else is needed.

Then, it’s time to integrate it.

Check if your Magento store is updated to the latest version and if your tool of choice is compatible. Then, back up your shop.

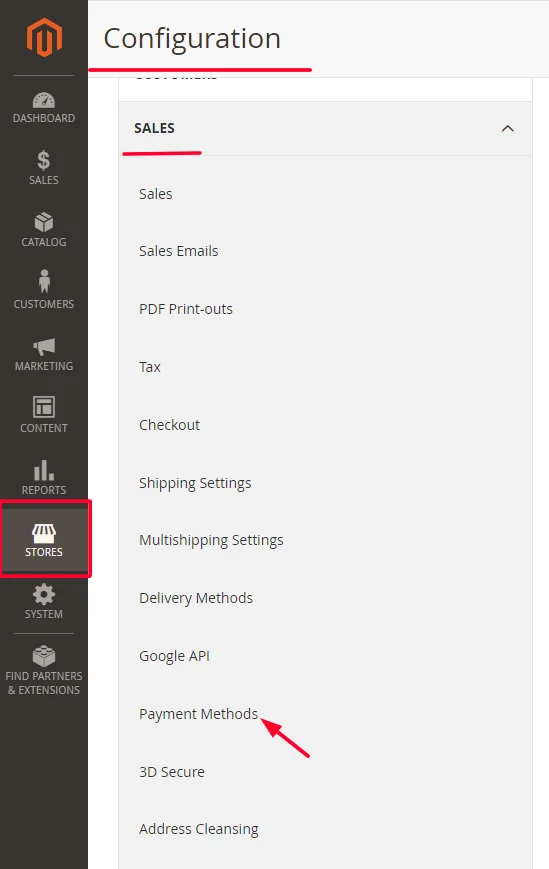

The next step is to go to Stoge > Configuration > Sales > Payment Methods.

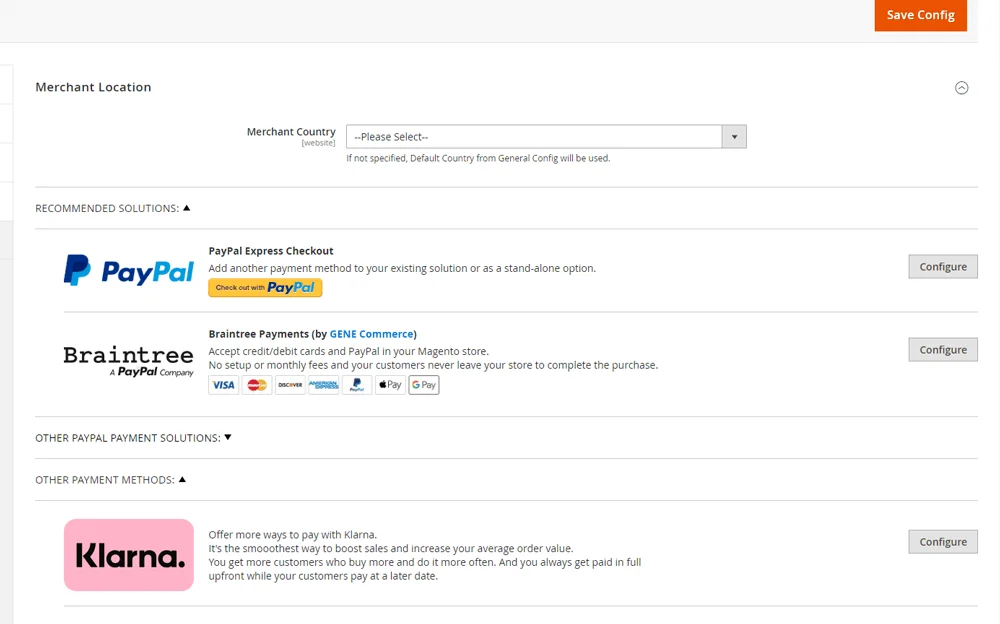

The Admin panel will open a new page with recommended solutions. If your choice is not one of them, navigate to Other Payment Methods.

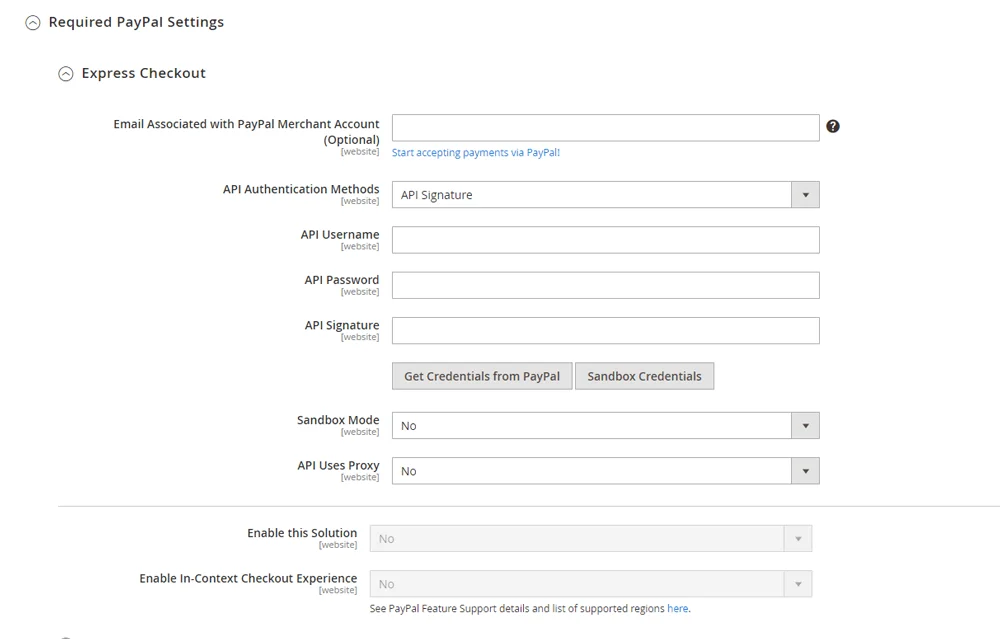

Next to every tool, you’ll see the Configure button. Click on it and add the necessary info.

You’ll find things like API credentials within your account info in the payment gateway’s settings.

Navigate to Enable this Solution and Enable In-Context Checkout Experience and set both to Yes. Then, click on Save Config in the upper right corner.

Congratulations! You have now integrated your Magento payment method of choice.

You can configure various settings like recurring payments and billing via your payment gateway account.

Multi-Currency Support

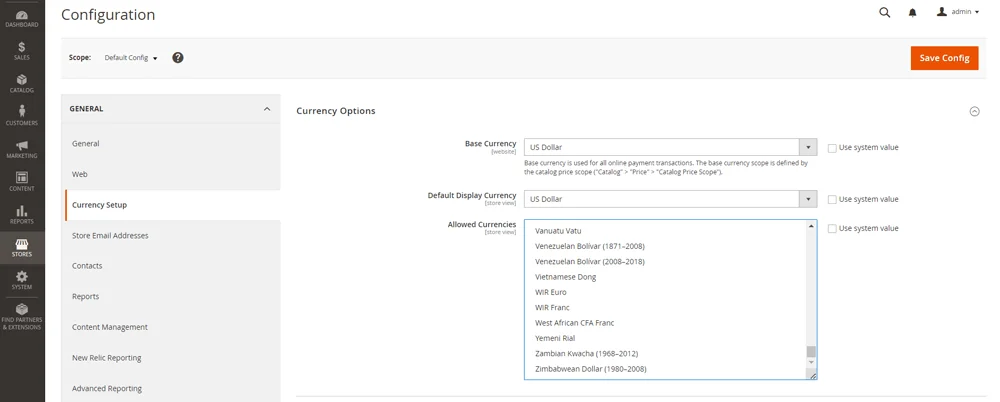

To enable Magento payments in various currencies, go to Stores > Currency Setup. This will open a window with all your currency options:

- Base – where you manage your online store accounts.

- Default Display – the one displayed to customers if they haven’t customized.

- Allowed – the options you want to offer to your customers.

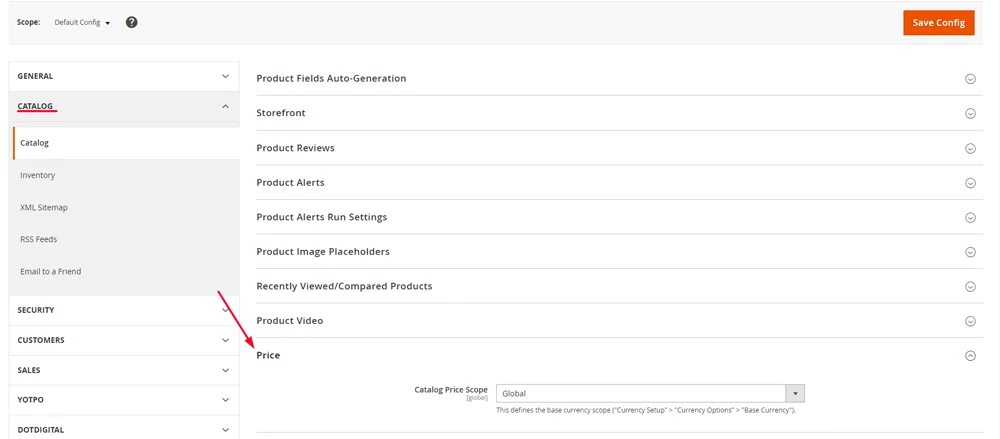

As you can see, the list is quite vast. To specify the scope of the base currency, navigate to Catalog > Price and set it to Global.

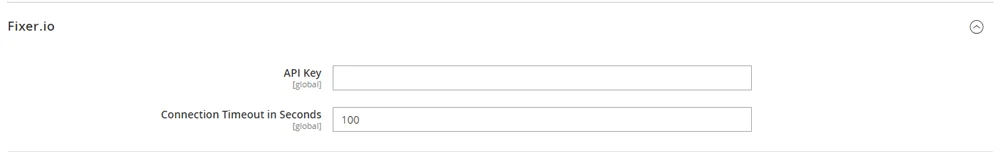

The next step is to Import settings. Go back to the Currency Setup page and click on Fixer.io. Specify the Connection Timeout in Seconds field.

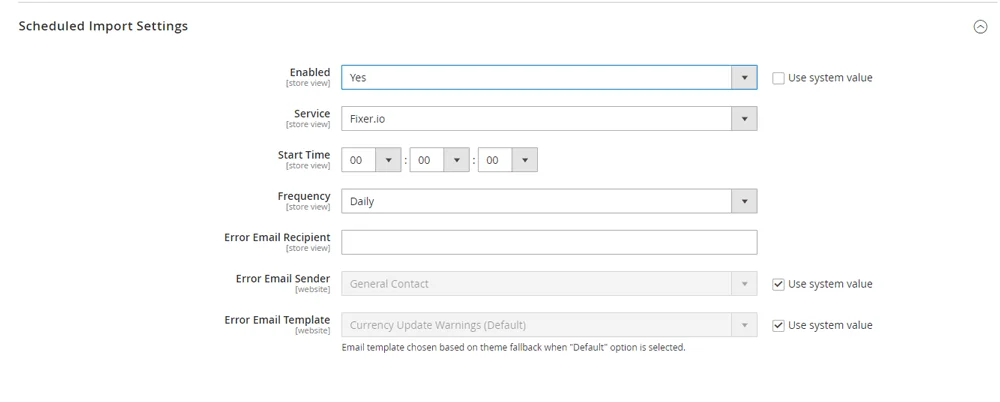

As a last step, you need to schedule the automatic update of currency rates. Navigate to the Scheduled Import Settings tab and set Yes in the Enabled field.

Set your rate provider in the Service field, and define the Start Time and Frequency of updates. Don’t forget to fill in the contact email in the Error Email Recipient field. Once done, save the changes and refresh the cache.

Voila! Your Magento store now supports multiple currencies.

Payment Gateway Testing

Before you open your Magento store to the public, you must test it to see if everything is functioning correctly. That includes your chosen payment gateway.

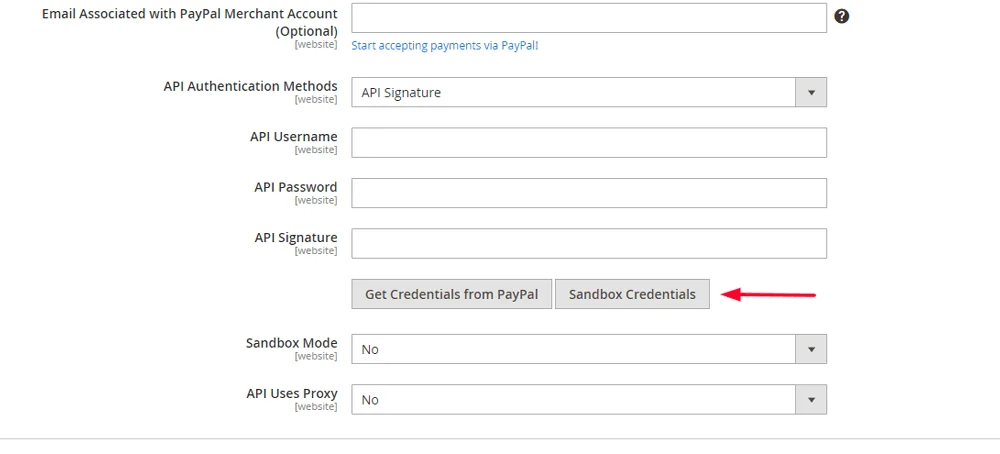

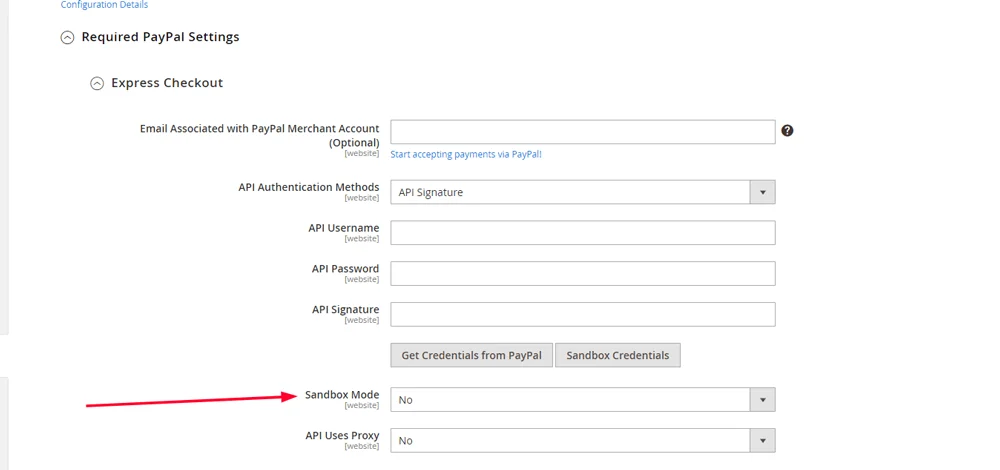

One way is to use а sandbox environment for testing purposes.First, you need to set up sandbox accounts with your payment gateway. This involves creating test accounts that simulate real payment environments without involving actual money. Then, navigate to Stores > Configuration > Sales > Payment Methods. Select your payment gateway and configure it to use the sandbox by entering the API credentials.

To activate Sandbox Mode, just choose Yes from the drop-down menu.

Then it’s time to get to work.

Conduct all transactions, edge case scenarios, refunds, voids, and recurring payment tests in the sandbox environment. Use the credit card numbers and other data provided by the gateway to simulate various transaction outcomes. Keep an eye out for any bugs or any features failing to deliver.

Once testing is complete and all issues have been resolved, switch the payment gateway configuration from sandbox to live mode. You do it by entering live API credentials to start processing real transactions.

Security Measures

Security is crucial when you’re dealing with large amounts of customer data.

And that’s exactly what you’ll be doing when managing a Magento store.

That’s why it’s crucial to select a reputable payment gateway. Such options offer built-in security features and are PCI DSS compliant. Make sure your website uses SSL/TLS encryption to secure data transmission between the customer’s browser and your server. Install an SSL certificate from a suitable vendor and regularly check its validity.

Another option is tokenization.

This means providing your customers with a unique identifier (token) that cannot be reverse-engineered. It reduces the risk of data breaches since actual card details are not stored on your servers. Additionally, all cardholder data can be masked during transmission and storage using strong encryption algorithms like AES-256. It’s also crucial to implement end-to-end encryption (E2EE).

Another important security practice – updates!

Regularly update Magento and all extensions. Regularly conduct security audits and vulnerability assessments to identify and fix potential security gaps. Employ secure coding standards to prevent common vulnerabilities, such as SQL injection, XSS, and CSRF attacks. Always enable two-factor authentication (2FA) for admin accounts to prevent unauthorized access. Make sure you have a strong access control system. You’ll need to monitor and test your network regularly.

Also.

Compliance.

Check out the appropriate PCI DSS Self-Assessment Questionnaire (SAQ) to assess your compliance status. Once completed, submit an Attestation of Compliance (AOC) to your acquiring bank or payment processor. This step confirms you meet PCI DSS requirements and have taken the necessary measures to protect cardholder data.

Last but not least – audit the transactions. Check for suspicious activities and set up alerts for unusual patterns that may indicate fraud. Maintain logs of all payment transactions and administrative activities. That way, you’ll always be prepared in case of issues.

Tokenization and Stored Cards

Tokenization in Magento refers to the process of replacing sensitive payment card information with a unique identifier. It is the so-called token, which cannot be reverse-engineered. This enhances security by ensuring that sensitive card details are not stored directly on the Magento server.

Here’s how it works:

- A customer enters their credit card details during the checkout process.

- They are securely transmitted to the payment gateway using client-side encryption methods—for example, JavaScript libraries.

- The payment gateway processes the card details and generates a token. It represents the customer’s card information but does not contain any actual information from it.

- The payment tool returns the token to your Magento server for storage.

- For future transactions, such as repeat purchases or subscription billing, Magento uses the stored token to communicate with the payment solution.

Tokenization is a key feature in almost all payment gateway tools that integrate with Magento. Once you’ve configured the solution, you should see the option. Ensure that it is enabled.

Fraud Prevention Measures

Major Magento payment providers such as PayPal and Authorize.Net come with built-in fraud detection features. But if you want to tighten security, you can integrate additional tools. Examples include Signifyd, FraudLabs Pro, and Kount.

Whichever option you go for, you’ll need to configure fraud detection rules based on your business model and risk tolerance. For example:

- Transaction velocity – Limit the number of transactions allowed per user within a specified timeframe.

- Geolocation – flag or block transactions from high-risk regions.

- Amount thresholds – set limits on transaction amounts to detect unusually large purchases.

Setting up Address Verification System (AVS) and Card Verification Value (CVV) checks. This will help verify the legitimacy of transactions. You’ll find the features in your payment gateway account settings, where you can enable them.

It’s also where you can enable 3D security. It requires customers to complete an additional verification step with their card issuer.

Those strategies will help you prevent data theft and will improve your reputation among potential leads.

Checkout Experience and Payment Flow

Here’s something that not so many people consider:

If you have a slow and frustrating checkout process, your customers will abandon their orders altogether.

So, first things first:

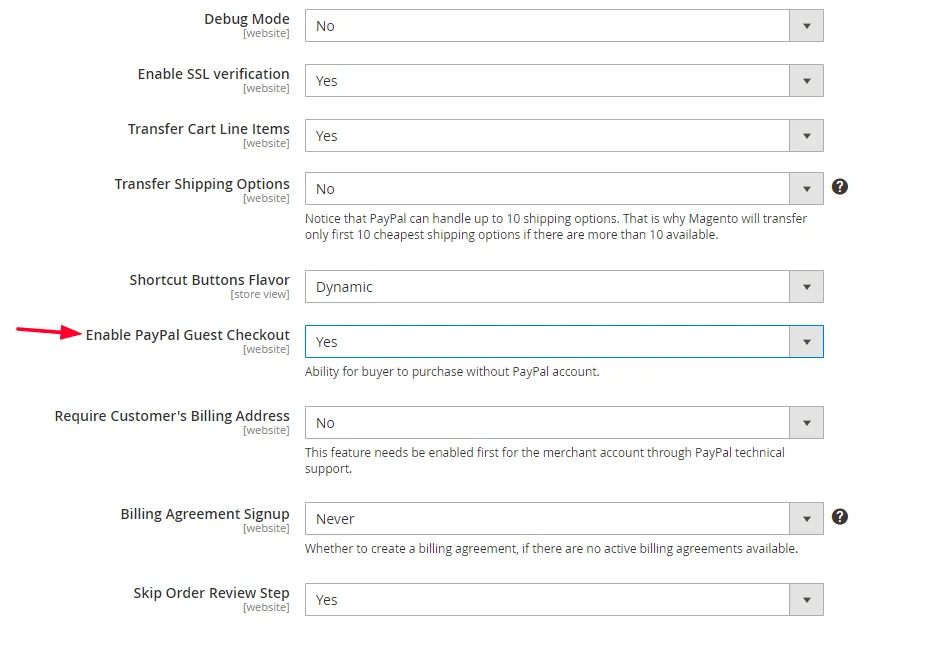

Enable guest checkout. This will allow your customers to purchase goods without creating an account.Navigate to Stores > Configuration > Sales > Payment Methods. Select your provider and go to Advanced Settings. Scroll down till you see the option.

Implementing a one-page checkout solution will also greatly benefit your customers. Magento has a built-in OnePage Checkout, which you can use or integrate with extensions like Amasty’s One Step Checkout.

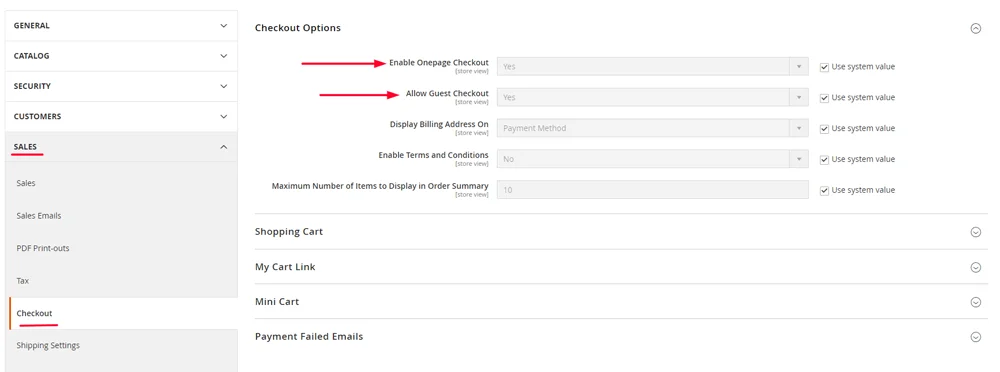

To enable Magento’s feature, navigate to Stores > Configuration > Sales > Checkout. Set Enable Onepage Checkout and Allow Guest Checkout to Yes.

Remember to only ask for essential information. Any additional field can increase the likelihood of cart abandonment, and that’s the last thing you want. Enable auto-fill to ease the whole process. Display all costs, including shipping, taxes, and fees, upfront. Unexpected charges are another major reason for cart abandonment, so they are to be avoided.

Enable customers to save their payment information for future purchases. This can be implemented via tokenization to ensure security. You should also provide a convenient “remember me” option for faster checkouts.

IMPORTANT: Optimize your checkout process for mobile. Large buttons, easy-to-read text, and touch-friendly elements are key.

Responsive Design for Payment Pages

To simplify the Magento order process and provide a seamless checkout experience, you need to ensure your payment pages are responsive and easy to navigate.

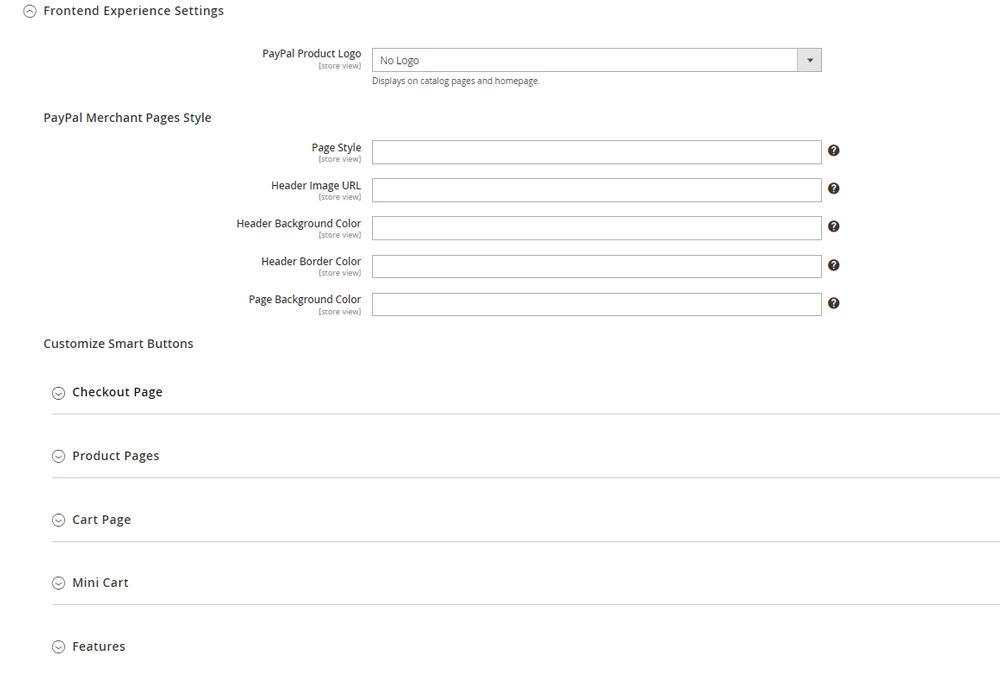

That’s why you need a fully responsive Magento theme – one that will adjust to different screen sizes and resolutions. It’s crucial for the layout to adapt to mobile shopping. A clean, uncluttered design with minimal distractions is preferred. Ensure that all buttons, like Add to Cart and Proceed to Checkout, are large enough to be easy to tap on touch screens. You can customize the frontend design of your payment gateway to fit those requirements. Go to Stores > Configuration > Sales > Payment Methods, choose a solution, and click Configure. Then, go to Advanced Settings and navigate to Frontend Experience Settings.

You’ll be able to customize:

- Header Image

- Background color for both pages and headers

- Button sizes

And more.

You can also simplify the whole process by enabling One Page Checkout.

Transaction Reporting and Analytics

Reporting and analytics are among the most important features to consider when choosing the best Magento payment gateway. The most popular ones have this option built in, but you should always check, just in case.

You should look for tools that provide summaries about:

- Successful payments

- Refunds

- Disputes

- Balance history

- Payouts

- Earnings

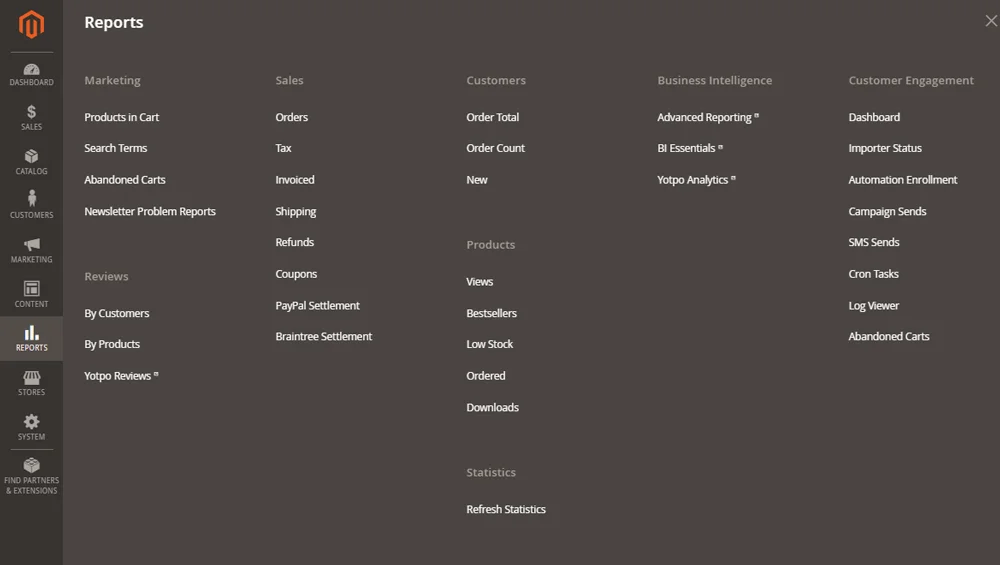

And more. All this information will enhance your data analysis. Magento also has built-in reporting tools that can complement the data from your payment gateways. All the necessary information is in the Reports section, under Sales.

Those reports will enable you to identify trends in sales volume, average order value, and peak sales periods. This will ease the processes surrounding marketing campaigns and inventory management as well.

Calculating customer lifetime value (CLV) provides insights into clients’ long-term value and can help establish strategies such as loyalty programs. In addition, it will allow you to improve checkout and payment processes, thanks to data on abandoned carts. You’ll be able to identify common drop-off points and implement solutions like cart recovery emails.

Monitoring payment success and failure rates helps identify and address common issues, such as expired cards or insufficient funds. Payment gateway analysis is also a great tool against fraud.

Keeping an eye on chargeback rates and their reasons will help you implement measures to reduce chargebacks.

Thanks to the reports, you’ll also be able to predict future revenue, which will enable you to prepare for budget and resource adjustments. On the other hand, tracking transaction fees and other costs associated with different payment methods helps optimize cost efficiency while maintaining customer convenience.

Alternative Payment Methods

Last but not least:

You can explore alternative methods such as digital wallets and Buy Now Pay Later (BNPL).

Those can significantly enhance the shopping experience and increase conversion rates by catering to diverse preferences.

The most popular digital wallets include Apple Pay, Google Pay, and PayPal. They enable users to complete purchases quickly without manually entering payment details. However, before you integrate one of those tools, make sure your Magento store supports these options. You’ll also need to configure some settings within your payment gateway and Magento admin panel.

Buy Now Pay Later (BNPL) services like Afterpay, Klarna, and Affirm have grown in popularity recently, mainly because they provide flexible payment options. They allow users to spread the cost of their purchases over several installments, often without interest. To integrate one, you must partner with the respective payment service provider. This usually involves adding the payment module, configuring it according to your store policies, and ensuring a smooth checkout process.

Hosting Magento with ScalaHosting

Searching for a web hosting provider for your Magento store?

Look no further!

ScalaHosting’s Managed VPS plans are scalable and flexible. They allow you to add and remove resources on a per-need basis. All our customers get their own IP addresses and dedicated CPU/RAM, so you can rest assured that you won’t be banned because of someone else’s actions. Online store owners get enhanced control and customization options, and thanks to Softaculous, you can easily install Magento with just a few clicks.

One of ScalaHosting’s flagship products is SPanel. This is our in-house developed platform that enables you to manage your projects with zero effort.

But that’s not all.

SPanel is integrated with SSHield – our AI-integrated security tool that successfully blocks 99.998% of web attacks before they reach your online shop.

You needn’t worry about the technicalities.

You can always count on a team of professionals to take care of your server. They will perform backups, updates, monitoring, and much more. The support operators are available 27/4 via live chat and email, ready to help you whenever needed.

Sounds good?

Contact us today, and we’ll take care of the rest.

Conclusion

A seamless payment process is one of the best ways to reduce cart abandonment rates and increase customer loyalty.

It all begins with choosing a suitable payment gateway.

Thanks to Magento’s robust architecture, you’re certainly spoiled by choice.

The integration process of all payment systems is straightforward. Whether using APIs for seamless in-site transactions or hosted solutions, it takes a few minutes to get them going. Just make sure to optimize your ecommerce site for mobile! Your goal is to create a secure, flexible, and efficient payment system that enhances the overall user experience. After all, you can’t put a price on customer loyalty.

FAQ

Q: What is a Magento payment gateway?

A: A Magento payment gateway is a service that integrates with the ecommerce platform so it can process credit card payments and other forms of electronic online payments. It ensures that all relevant data is securely transmitted and processed. Magento supports various payment gateway options that can be easily added to your store.

Q: Is Magento a POS system?

A: No, Magento is not a POS system. It is an ecommerce platform designed for creating and managing online stores. However, Magento can be integrated with various payment gateways to enhance its functionalities.

Q: What is the best payment gateway for my website?

A: The best payment gateway for your website will depend on your specific business needs and technical capabilities. PayPal, Stripe, Authorize.Net, Stripe, and Stax are all popular options for their ease of use and wide coverage. Make sure the platform you’re using can be integrated with the payment options you’re considering.